Accounting Transactions Exercises With Answers

Paid by cheque 35000 22 Stationery bill paid by cheque 2000 22 Telephone bill by cash 500 31 Paid rent by cash 2000 Paid salaries by cash 3000 Withdrew cash personal use 5000. Jan 1 Issued 100000 in stock to owners in exchange for cash to start the business.

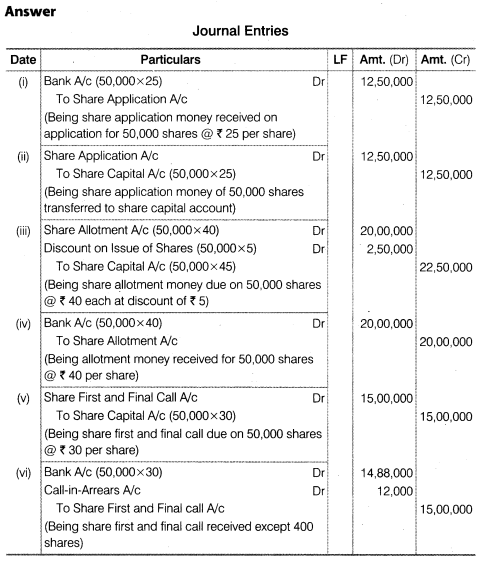

Journal Entry Problems And Solutions Format Examples Mcqs

The accounting equation exercises quiz is one of many of our online quizzes which can be used to test your knowledge of double entry bookkeeping discover another at the links below.

Accounting transactions exercises with answers. Debit Credit In Accounting Quiz. SHORT ANSWER QUESTIONS EXERCISES AND PROBLEMS A Question Accounting has often been called the language of business. Purchased for cash a one-year insurance policy for 900.

Bought inventory for cash. Requirements a Write up the ledger accounts using the three column cash book. Debits and Credits Test.

In all journal entries the total of debit account amounts should be equal to the total of credit account amounts. Credit 38000 15 Sold goods for cash 9000 21 Steve Co. This accounting transactions quiz is one of many of our online quizzes which are used to test your knowledge of double entry bookkeeping discover another at the links below.

Paid off the creditors for inventory purchases from transaction 7. Ballada Warren Reeve Duchac Horngrens Financial Managerial Accounting Problem 1 Meg McKinney opened a public relations firm called Solid Gold on August 1 2018. What is the source of the money in this exchange.

Answers to chapter activities 15 Accounting for purchases returns and 7 discounts 71 a 1 Purchases account. Evaluate each item and prepare the journal entries that would be needed for the initial recording and subsequent end-of-20X3 adjusting entry. This Accounting test paper on Accounting Basics is divided into four sections.

Workbook has 88 questions and exercises starting from the accounting equation and basic concepts to journal entries T-accounts the trial balance financial statements the cash flow statement inventory depreciation provisions doubtful debts year-end entries bank reconciliations and more. Received a one-year advance from tenants for rental property. During June Ming Chen the owner completed these transactions a Owner.

A An accounting information system collects and processes transaction data and communicates financial information to decision makers. In what respects would you agree with this description. Ateneo de Davao University School of Business and Governance Management Accounting Department Financial Transaction Worksheet Exercises BSMA 1A July 2020 Sources.

ANSWERS TO QUESTIONS 1. During the month of January 2011 the following transactions took place. The purchase of a car on credit is an example of an accounting transaction.

Refer to a previous exercise for instructions on how to review account balances. In order to record a financial transaction we need to be able to answer these four questions. Jennifer Agueliyah Boutique Jennifer Agueliyah is a dealer in fancy designer.

Purchased merchandise on open account. Mr Harveyman sells electrical appliances such as video machines fridges TV etc to local residents. When the debit side total is same as the credit total a journal entry is balanced.

Exercise 1-13 Identifying effects of transactions using the accounting equation LO P1 stock Ming Chen began a professional practice on June 1 and plans to prepare financial statements at the end of each month. Jan 5 Borrowed 50000 from the bank by signing a notes payable. Since the asset is recorded on the debit side and the car is an asset money owed in credit is a liability and falls on the credit side.

Costs Included in Inventory. You must choose whether the transactions would be recorded in the Cash. How might you argue that this description is deficient.

Gave a 120-day note to a bank for a loan. What is the GL account number for Supplies Expense. 40 - 41 Source Documents 101 Cash Register Roll 102 Receipt Book42 - 43 11.

B Extract a trial balance at 31 January 20 5 c Prepare a trading and profit and loss account for the months ended 31 January 20 5 and a balance sheet at that date. Jan 1 Bought goods for cash 70000 2 Sold goods to Steve Co. Perez Company had the following transactions during January.

1 MarchMr Harveyman invested 4000 cash into the business. Exercise 2 37 Transactions Cash A O L The Effect of transactions on the Accounting Equation Exercise 3 37 - 38 Exercise 4 38 Exercise 5 38 - 39 Exercise 6 39 Exercise 7 39 10. In this exercise you are given a list of transactions and you must determine in which journal the transaction should be recorded.

Identify the Debit Entry. On September 1 201 Company M purchased a building at 1200000. How was the money used.

B Comprehensive Review Questions Why do we need financial information. An accounting information system applies regardless of whether manual or com-puterized procedures are used to process the transaction data. Keeping records of transactions.

Financial transactions are exchanges of things of value. The following shows the transactions happened in Mr Harveymans business in the first week of March. Where did the money come from.

Answer to Exercise 1-13 Identifying effects of transactions. Accounting Cycle Exercises II 8 Problem 1. Let us assume that a car costs 10000 on credit by owing money next month.

Worksheet Problem 1 Following are three separate transactions that pertain to prepaid items. Depreciation expense Cost Salvage value x Units incurred during the current period Total units expected from the asset Exercise 2. Review the supplies account and bank account to answer the following questions.

Section A10 questions on True Or False Section B15 questions on Fill The Blank. Accounting Cycle Exercises III 6 Problem 1. 44 - 45 46 Journals Cash Receipts Journal 111 Recording Cash Receipts 47 Exercise 8 Exercise 9.

Entity A had the following transactions in December 201. Solution Solution 1 GENERAL JOURNAL Date Accounts Debit Credit 1-2X5 Cash 20000 Capital Stock 20000 Issued stock to Robert Dennis for cash 1-4-X5 Equipment 15000 Accounts Payable 15000 Purchased equipment on account 1-12-X5 Cash 30000 Revenues 30000 Provided services to customers for cash. What was either acquired or paid for by this exchange.

2 Value Added Tax account 72 d Account of M Ostrowski a trade payable 73 b and d are True a and c are False 74 a Purchases Day Book PDB38.

Solution To Exercise 2 3 Problem Solving Survival Guide To Accompany Financial Accounting 8th Edition Book

Solved Exercise 1 Understanding Double Entry Accounting Chegg Com

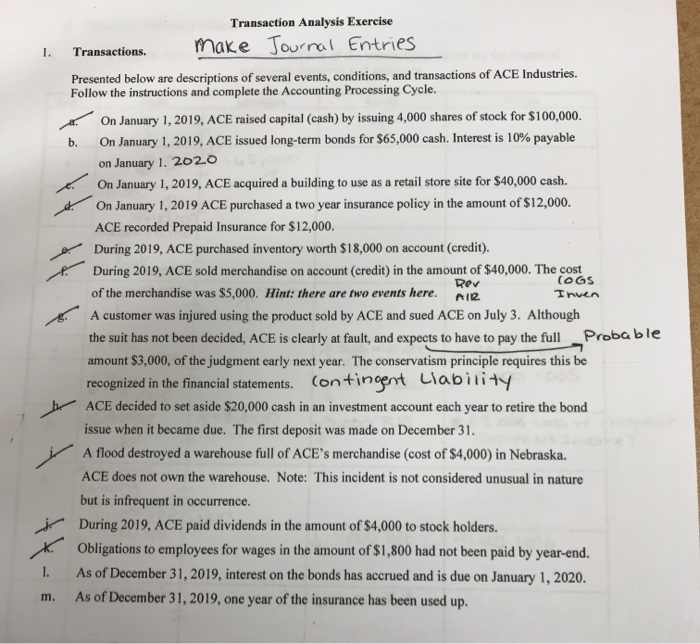

Solved Transaction Analysis Exercise Make Journal Entries 1 Chegg Com

Solved Exercise Begins An Accounting Cycle That Will Be Chegg Com

Journal Entries Exercises With Answers Pdf

Accounting Transactions Exercises Pdf

Journal Entry Problems And Solutions Format Examples Mcqs

Journal Entry Problems And Solutions Format Examples Mcqs

Ch01 Solution W Kieso Ifrs 1st Edi

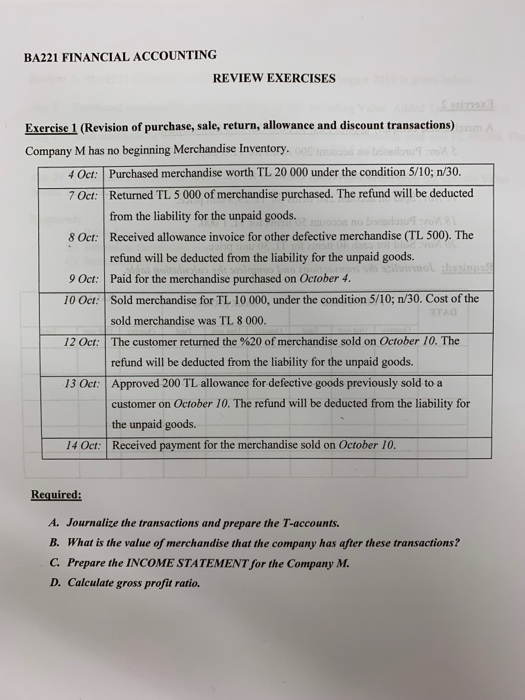

Solved Ba221 Financial Accounting Review Exercises Exercise Chegg Com

Accounting Archives How To Make A Simple Financial Transaction Worksheet

Journal Entry Problems And Solutions Format Examples Mcqs

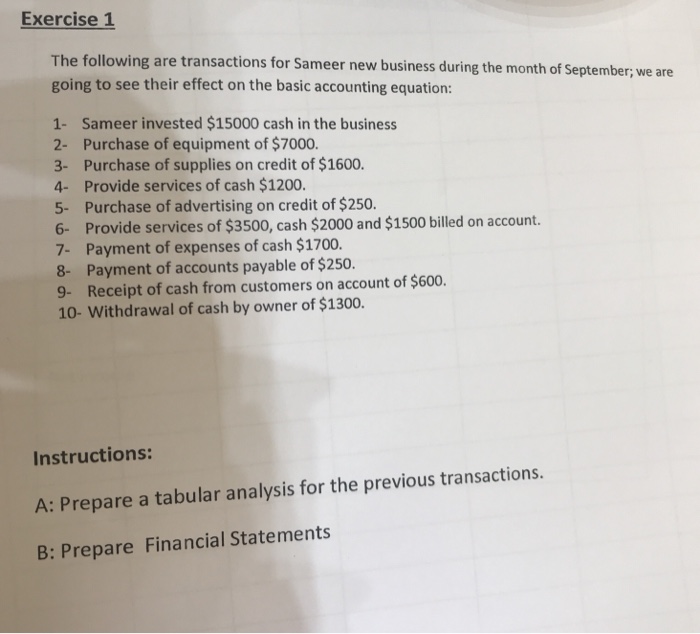

Solved Exercise 1 The Following Are Transactions For Sameer Chegg Com

Posting Komentar untuk "Accounting Transactions Exercises With Answers"