Accounting G&a Definition

Labor for strategic planning business development efforts and to manage or perform administrative functions. Some business expenses can be allocated to specific departments or projects for example labor and supplies for a manufacturing project or the sales forces driving to the sales department.

Is Your G A Base Right For You

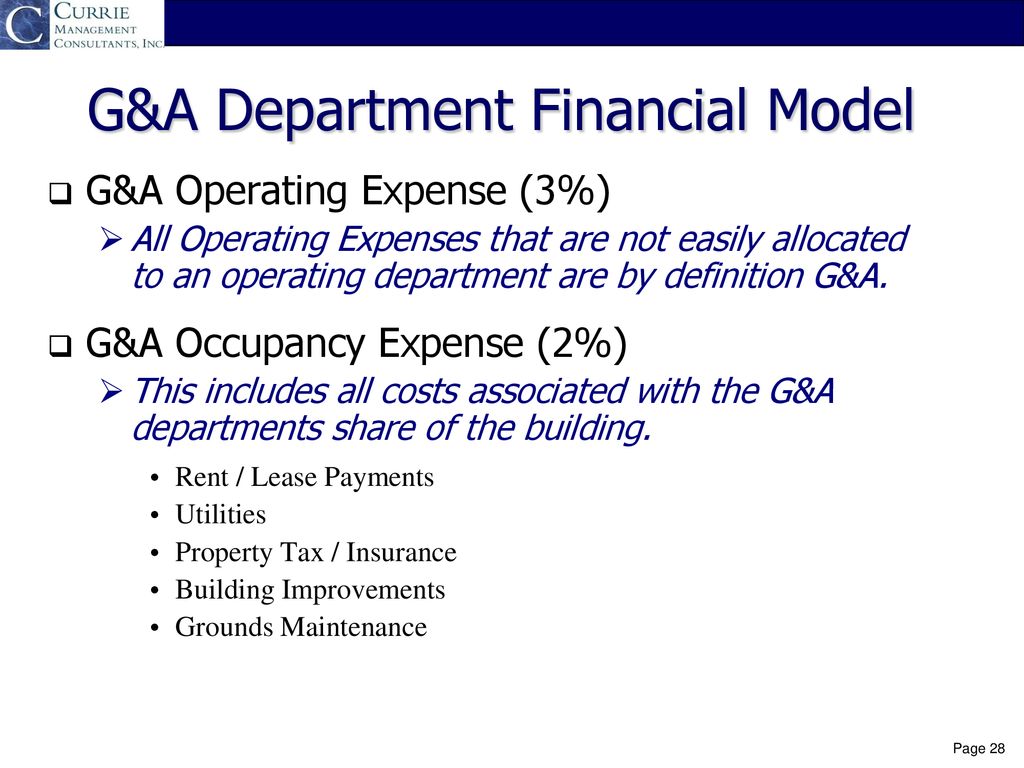

SGA expenses consist of the combined costs of operating the company which breaks down to.

Accounting g&a definition. General and administrative expenses also called selling general and administrative expenses or SGA are the indirect costs of running a business. They are the sum of all the activities that hopefully generate a profit. Some examples of GA expenses would be accounting legal general liability insurance bank fees and corporate licenses.

SGA alternately SGA SAG GA or SGNA is an initialism used in accounting to refer to Selling General and Administrative Expenses which is a major non-production cost presented in an income statement statement of profit or loss. E An official of a company whose salary travel and subsistence expenses are charged regularly as general and administrative GA expenses takes several business associates on what is clearly a business entertainment trip. Common examples of Overhead Cost.

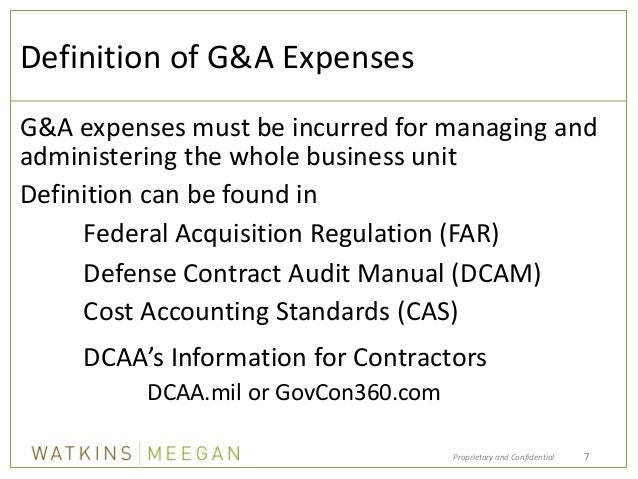

An expense in accounting is the money spent or costs incurred by a business in their effort to generate revenues. Government accountants may examine tax reports and financial statements prepare documents for the government or the general public and assist with managing government funds. To be considered a GA expense of a business unit the expenditure must be incurred by or allocated to the general business unit.

GA is accounting shorthand for general and administrative expenses. General and administrative expense is those expenditures required to administer a business and which are not related to the construction or sale of goods or services. It is important to understand the difference between cost and expense since.

Overhead costs support the efforts of the direct labor workforce not necessarily related to a specific contract. Examples of GA expenses include. General and Administrative GA expenses are the residual costs necessary to run a business regardless of whether you have government contracts.

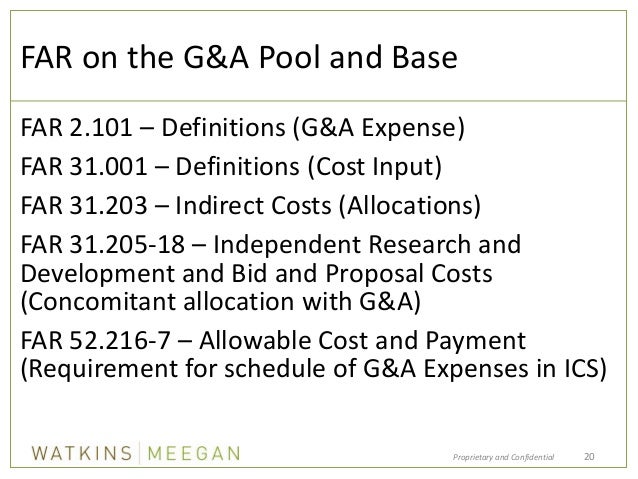

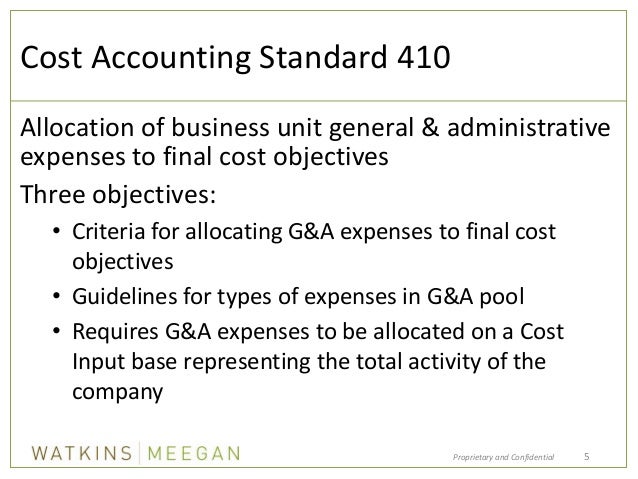

In general Government contractors are constrained to use of three specific bases for allocation of the General and Administrative GA costs of the organization. GA refers to expenses that benefit the entire company rather than one department or. Small business personnel commonly wear multiple hats and often need to divide their time between many categories.

Accounting staff wages and benefits. Common examples of GA Costs. Salary and other costs of the executive staff of the corporate or home office Salary and other costs of such staff services as legal accounting public relations and financial offices.

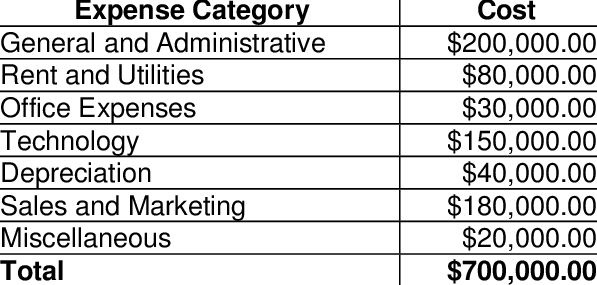

Chart of Accounts Example for SGA Expenses. Overhead and GA have a somewhat less clear definition. The bases are defined in Cost Accounting Standard 410 48 FCR 9904410 but are incorporated into the FAR in 312032.

Generally accepted accounting principles GAAP definition. A set of rules and guidelines developed by the accounting industry for companies to follow when reporting financial data. Government accounting refers to positions in the federal state or local governments who are responsible for financial reporting and auditing taxation and so on.

If an employee does not work on direct labor projects and performs functions that relate to the overall. Following these rules is especially critical for all publicly traded companies. An example of a complex chart of accounts for selling general and administrative expenses organized by related categories versus a simple chart of accounts organized alphabetically.

Generally Accepted Accounting Principles. GA Expenses means the general and administrative expenses of Borrower including capitalized general and administrative expenses calculated in accordance with the Accounting Standards excluding all non-cash charges and performance-based compensation pursuant to a plan approved by Lender in writing. It is important to note that under the accrual method of accounting GA is recorded for the period in which it is incurred and not necessarily the period in which it is paid.

This information is needed to determine the fixed cost structure of a business. 100 SALARIES WAGES. First and by far the most common of the three is the cost.

Examples of general and administrative expenses are. Accounting and auditing office of the United States government. GASB Group that has authority to establish standards of financial reporting for.

An independent agency that reviews federal financial transactions and reports directly to Congress. Essentially accounts expenses represent the cost of doing business.

Sg A Expenses How To Reduce Sg A Expenses With Examples Detailed Guide

Best Practices Session Currie Summit Ppt Download

Is Your G A Base Right For You

Is Your G A Base Right For You

G A Definition General Administrative Expenses Investinganswers

Accounting Terms Glossary Of Accounting Terms And Definitions By Ruralbatch6987 Issuu

Guide To General And Administrative Expenses G A Indeed Com

What Is The Accounting Term G A

Expense Definition Finally Learn

Selling General And Administrative Expenses All You Need To Know

Is Your G A Base Right For You

Administrative Costs In Accounting Definition Examples Personal Accounting

/GettyImages-1061289414-f23970e2bf5641ff933f0cd54bd54a22.jpg)

What Are General And Administrative Expenses

:max_bytes(150000):strip_icc()/close-up-of-female-accountant-or-banker-making-calculations--savings--finances-and-economy-concept-980973568-03a13a494012414aaa835de128892345.jpg)

General And Administrative Expense G A Definition

Posting Komentar untuk "Accounting G&a Definition"