In Accounting Bases Of Ascertaining Profit Or Loss Is

Accrual or Mercantile Basis of Accounting. The process of ascertaining the amount of profit earned or the loss incurred during a particular period involves deduction of related expenses from the revenue earned during that period.

Ascertaining Profit Or Loss From Incomplete Records Through Statement Of Affairs Accountancy

Accounting management by making plans taking decisions and controlling activities.

In accounting bases of ascertaining profit or loss is. A Debited to his current account b Credited to his current account c Credited to profit loss. Salary paid to partner should be. It states that expenses incurred in an accounting period should be matched with revenues during that.

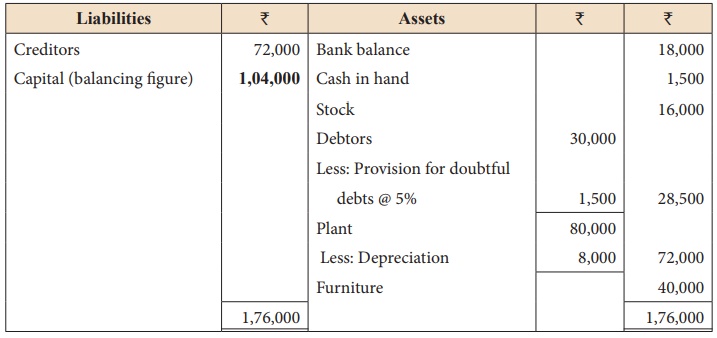

Accounting Transactions and Final Accounts 1 Gross profit is a Cost of goods sold Opening stock b Excess of sales over cost of goods sold c Sales fewer Purchases d Net profit fewer expenses of the period 2 Net profit is computed in the a Profit and loss account b Balance sheet c Trial balance d Trading account. Ii From the date of incorporation to the closing of the accounting year or post-incorporation period. There are two bases for ascertaining profit or loss.

Theory Base of Accounting MCQ Class 11 Accountancy provided below covers all important topics given in this chapter. BASES OF ACCOUNTING. The matching concept emphasizes exactly on this aspect.

Another objective of accounting is that it helps in ascertaining the net profit earned or loss suffered on account of carrying the business which is done by keeping a proper record of all books of accounts with respect to revenues and expenses of a particular period. In accounting basis of ascertaining profit or loss. Cash Basis of accounting is a system in which transactions are recorded when cash is received or paid.

A Profit and Loss Account is prepared at the end of the year and thereafter the profits or losses between the two periods are allocated. There are two bases of ascertaining profit or loss namely 1 Cash Basis and 2 Accrual Basis. These MCQs will help you to properly prepare for exams.

Question12 Explain any four objectives of accounting. Under this system of accounting transactions are recorded in the books of accounts only on the receipt payment of cash. This is done by keeping a proper record of revenues and expenses of a particular period.

If revenue exceeds expense then it is said the business is running profitability and if expenses exceed revenue it can be said the business I running under loss. Where the proprietor maintains incomplete records he only prepares cash account debtors account and creditors account properly. Singhshruti1103 is waiting for your help.

See what the community says and unlock a badge. Data required for the fixation of selling price is provided by. Ascertainment of Profit and Loss.

CASH BASIS OF ACCOUNTING. The income is calculated as the excess of actual cash receipts in respect of sale of goods service properties etc over actual. The matching concept emphasises exactly on this aspect.

The income statement gives the data of profit and loss of a financial year. The profit and loss account is prepared at the end of a period and if the amount of revenue for the period is more than the expenditure incurred in. Cash Basis of Accounting.

Accounting provides information about the business to its users on a real time basis and at the end of accounting period. To ascertain whether the organization have earned profit or incurred loss an Income statement or Trading and profit loss account is prepared. Accrual Basis of Accounting.

1cash basis 2 accrual basis 3 either cash or accrual basis 4 none of the above. Cash Basis of Accounting. Iii Accrual basis is a more appropriate basis for determining profits as expenses are matched against revenue earned in relation thereto.

Ascertain the Financial Position. Profit and loss accounting can be defined as a statement prepared at the end of an accounting period usually a year or quarter which summarizes all revenue nature transactions like revenue earned various costs and expenses incurred providing insights into the companys ability or inability to earn profits revenue and cost trends during that period and is also. Iv Accrual basis of accounting gives a true and fair view of the results of operations of business and financial position of the business.

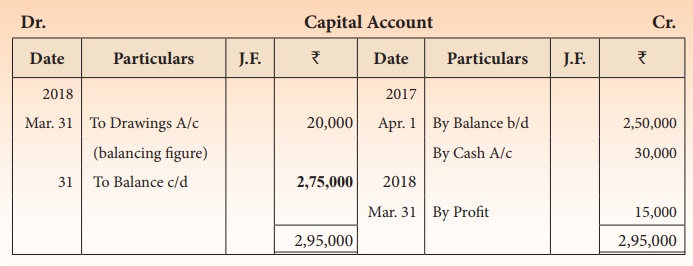

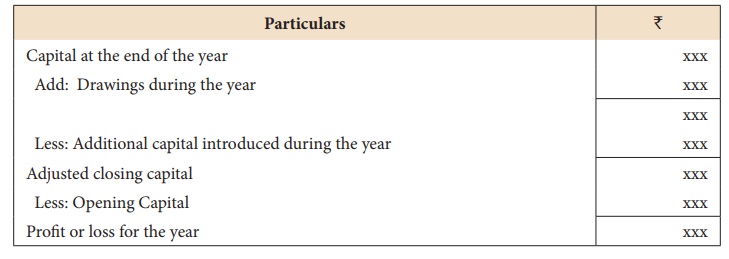

Profit is ascertained by comparing the capitals between two accounting periods viz capital at the beginning and capital at the closing when double entry system is not followed. Accounting helps is ascertaining the net profit earned or loss suffered on account of carrying the business. The primary objective of accounting are to maintain systematic records of transactions ascertaining profit or loss ascertaining financial position assisting the management and communicating accounting information to users.

Ascertainment of Profit or Loss. MCQ Questions Class 11 Accountancy Chapter 2 Theory Base of Accounting. Question11 Explain the primary objectives of accounting.

The exact cause of increase or decrease in profit or loss is disclosed by. In accounting Profit Loss account is prepared to know the results of business operation for a particular period of time. The accounting records that are not maintained as per the double entry system but as per single entry are called Incomplete Records.

I From the date of purchase to the date of incorporation or pre-incorporation period. There are two bases of accounting from the point of view of the timing of recognition of revenue and expense for calculating the profit from the business activities at the end of a given period. It is possible that in the same accounting period the business may either pay or receive payments that may or may not belong to the same accounting period.

Statement of AffairsIncrease in Net Worth Method. Ascertaining the reasons for profit or loss. The balance sheet gives the overall position of the organization.

Ascertaining profit or loss earned in a business by preparation of trading and profit and loss account. The business entities follow this concept mainly to ascertain the true profit or loss during an accounting period. Add your answer and earn points.

Definition of Profit and Loss Accounting. The process of ascertaining the amount of profit earned or the loss incurred during a particular period involves deduction of related expenses from the revenue earned during that period. Ascertaining Profit Or Loss.

Cash Basis of Accounting. It states that expenses incurred in an accounting period should be matched with revenues during that period. To ascertain the operational profit or loss.

They measure the operating performance of the business during the accounting period.

Pricing Formula Business Checklist Small Business Plan Startup Business Plan

Ascertaining Profit Or Loss From Incomplete Records Through Statement Of Affairs Accountancy

X3 Chart Pattern Scanner Mt5 Free Download And Review In 2021 Optimization Pattern Scanner

Accounting For Not For Profit Organisation Cbse Notes For Class 12 Accountancy Learn Cbse Learn Accounting Accounting Accounting Notes

P And L Statement Template Best Of P L Spreadsheet Template Spreadsheet Templates For Busines Profit And Loss Statement Statement Template Spreadsheet Template

What Is Profit Loss Account Profit Loss Statement Tally Solutions

Accounting For Not For Profit Organisation Cbse Notes For Class 12 Accountancy Learn Cbse Learn Accounting Accounting Accounting Notes

Ascertaining Profit Or Loss From Incomplete Records Through Statement Of Affairs Accountancy

Income Statement Definition Explanation And Examples

Dissolution Of Partnership Firm Cbse Notes For Class 12 Accountancy 3 Accounting And Finance Partnership Capital Account

/dotdash_Final_Common_Size_Income_Statement_Oct_2020-01-f6706faee5644055954e9e5675485a5e.jpg)

Common Size Income Statement Definition

Pipfinite Reversal Pro Free Download And Review In 2021 Reverse Forex Success Rate

X3 Chart Pattern Scanner Mt5 Free Download And Review In 2021 Optimization Pattern Scanner

Posting Komentar untuk "In Accounting Bases Of Ascertaining Profit Or Loss Is"