Accounting Transactions Exercises With Answers Pdf

For purposes of testing and exams its important to make sure you not only answer questions and exercises correctly but also complete them at the right speed. Step 2 Business transactions are recorded in the Journal chronologically by account name Step 3 Information is posted copied from the Journal to the General Ledger book in which accounts are recorded.

Accounting Transactions Exercises Pdf

Sold goods to Din Muhammad Rs.

Accounting transactions exercises with answers pdf. Accounting Cycle Exercises I 6 Problem 1. Record in a five-column journal transactions to set up a business. Cost of sales The cost of buying or producing the goods for resale.

Distributed goods worth Rs. Worksheet Problem 1 Juniper Corporation provided the following summary balance sheet information. Apply the basic accounting equation create a spreadsheet please see comprehensive example to complete a transaction analysis for each transaction hint.

Identify accounting concepts and practices related to journalizing transactions. Transactions between a Firm and its Owner. A An accounting information system collects and processes transaction data and communicates financial information to decision makers.

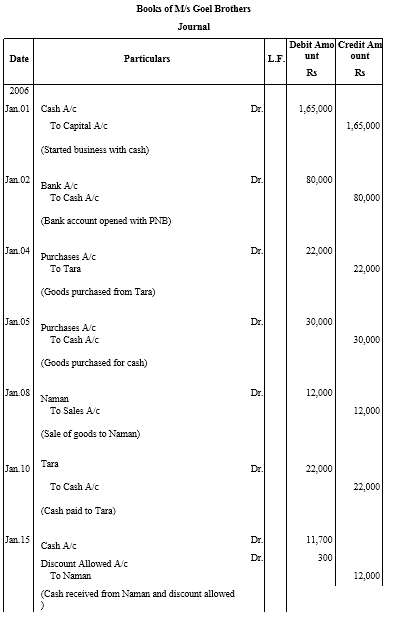

The cost of the merchandise sold was 5625. Jennifer Agueliyah Boutique Jennifer Agueliyah is a dealer in fancy designer. Journal Entries and Ledger Question and Answer.

6000 subject to 10 trade discount by cash. Prepare income statement at the end of December 31. 110 Questions Answers on True Or False on Accounting Basics A C OU N TI G EP S D BL R Y M ru eFals 1.

Ateneo de Davao University School of Business and. Evaluate each item and prepare the journal entries that would be needed for the initial recording and subsequent end-of-20X3 adjusting entry. View Financial Transaction Worksheet Exercises Answers plus Journal entriespdf from ACCOUNTING Accounting at Ateneo de Davao University.

In order to correctly enter transactions in the bookkeeping records it is necessary to be able to identify the effect of each transaction on the assets liabilities and equity of the business. These activities help the busi-ness keep its accounting records in an orderly fashion. The accountant analyzes each business transaction to decide what information to record and where to record it.

Workbook has 88 questions and exercises starting from the accounting equation and basic concepts to journal entries T-accounts the trial balance financial statements the cash. The analyzing and recording process consists of. Journalize the following merchandise transactions.

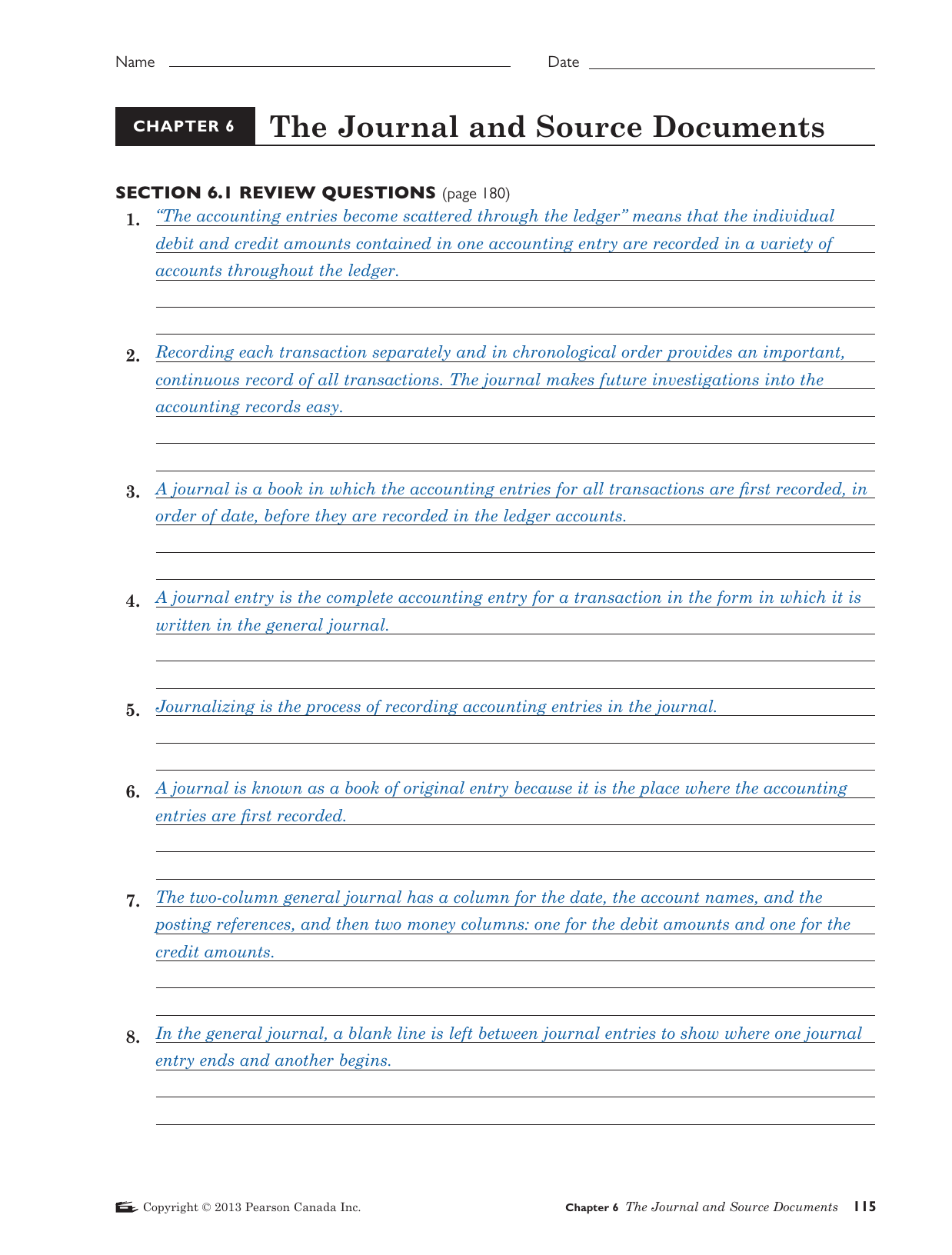

Wrote a check for 100 If you only have the information from Example 1 then you know the answers to Questions 2 and 3 but not to. Take a look at Figure 61 which describes accounting activities and their sequence. Define accounting terms related to journalizing transactions.

Accounting Test Question With Answers On Accounting Equation and Debit And Credit _____ Page 9 ˇ ˆ ˇ ˇ ˇ ˆˇ Section A. 800 and cash sales of Rs. Although transactions of a business mostly relate to any monetary exchange the term accounting transaction specifies the nature of recordkeeping of those transactions.

Test your knowledge of double entry bookkeeping with our accounting transactions quiz. Usefulness objectivity and feasibility are the three basic norms generally found in accounting principles 3. Financial Accounting Fundamentals Ch.

A is any financial event that changes the resources of a firm. Accounting transactions are the activities of financialmonetary exchanges that take place within a companys business environment. 200 as free samples and goods taken away by the proprietor for.

The accounting process starts with the analysis of business transactions. Transactions will impact the Assets Liabilities and Owners Equity of a firm To analyse determine how this impacts the accounting equation Assets Liabilities Owners Equity of a firm 9. An accounting information system applies regardless of whether manual or com-puterized procedures are used to process the transaction data.

The accounting period of a business is separated into activi-ties called the accounting cycle. Page 6 Internal transactionstransactions that may involve exchanges between divisions within a company or payments to employees. Questions 1 and 2 describe both sides of a transaction what we did with the money and where the money came from.

Requirements a Write up the ledger accounts using the three column cash book. Answers-True or False ˇ ˆ. 6-3 Example Exercise 6-3 43 b.

83 Exercises on the nature of inputs and outputs in accounting 63 9. For example purchases sales pay-ments and receipts of cash are all business transactions. Sales revenue Income generated from the trading activities of the business.

Purchased from Kareem goods of list price of Rs. Record in a five-column journal transactions to buy insurance for cash and supplies on account. When to Record a Transaction 91 A drill to practise the timing of the record of a transaction 65 92 Exercises on the timing of the accounting record 69 10.

Worksheet Problem 1 Following are three separate transactions that pertain to prepaid items. We cannot record transactions without answers to both of these questions. Fill In The Blanks ˇ ˆ.

31 20X9 Total Assets 2500000 3800000 Total Liabilities 900000 1300000 Compute net income for the year ending December 31 20X9 under each of the following independent scenarios. Provide many examples of business transactions and have learners identify the changes to the three main components. Accounting Principle is general law or rule followed in the preparation of financial statements 2.

Use a watch or clock to time yourself while attempting this exercise. ANSWERS TO QUESTIONS 1. In this chapter you will use Steps 1 2 and 3 of the account-ing cycle.

Accounting Cycle Page 2 of 9 Step 1 Business transactions occur that result in source documents such as receipts bills checks etc. Received payment less the discount. 1 st January 2017 Saeed Ahmad started business other transactions for the month of June as follows.

Bookkeeping Transactions 6 These items you will find on the statement of profit or loss. Prepare statement of retained earnings equity at the end of December 31. B Extract a trial balance at 31 January 20 5 c Prepare a trading and profit and loss account for the months ended 31 January 20 5 and a balance sheet at that date.

Accounting Cycle Exercises III 6 Problem 1. Enter the balances provided first. Gross profit The profit remaining after the cost of sales have been deducted from sales revenue.

Sold merchandise on account 7500 with terms of 210 n30. Answers to Section B. If you want more practice with full accounting questions and answers you should get the official exercise book for this site Volume 2 in the Accounting Basics series.

Accounting Transaction Analysis Double Entry Bookkeeping Accounting Analysis Bookkeeping And Accounting

As A Bookkeeper You Complete Your Work By Completing The Tasks Of The Accounting Cycle It S Called A Cycle Beca Accounting Cycle Accounting Accounting Basics

Journal Entry Problems And Solutions Format Examples Mcqs

Use Journal Entries To Record Transactions And Post To T Accounts Principles Of Accounting Volume 1 Accounting Basics Accounting Principles Learn Accounting

Journal Entries Exercises With Answers Pdf

Accounting Transactions Exercises Pdf

Ch01 Solution W Kieso Ifrs 1st Edi

Accounting Transactions Exercises Pdf

Adjusted Trial Balance Worksheet Template In 2021 Trial Balance Worksheet Template Accounting Principles

Bank Reconciliation Exercises And Answers Free Downloads Reconciliation Best Investment Apps Accounting Notes

Accounting Transactions Exercises Pdf

Accounting Transactions Exercises Pdf

Accounting Transactions Exercises Pdf

Book Keeping And Basic Accounting Accounting Principles Budgeting Process Accounting

Posting Komentar untuk "Accounting Transactions Exercises With Answers Pdf"