G&a Accounting Meaning

General and administrative expenses also called selling general and administrative expenses or SGA are the indirect costs of running a business. Some may include these specialty areas as unique types of accounting while others include them in the four types listed below.

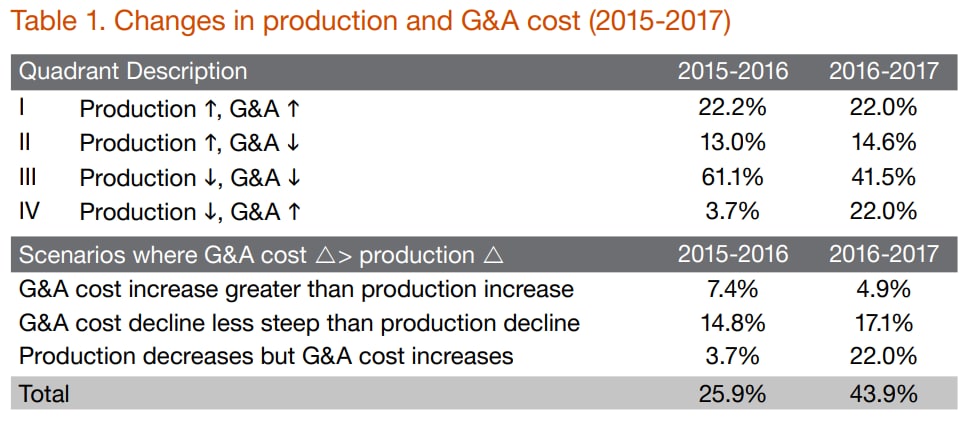

The Soaring Cost Of G A And Why Ceos Should Care Oil Gas Journal

This information is needed to determine the fixed cost structure of a business.

G&a accounting meaning. Continuing accounting significance CONTINUING ACCOUNTING SIGNIFICANCE means matters normally included Read More CONTINUING AUDITOR. What does GAAP abbreviation stand for. Bonuses for people who primarily charge their time to GA.

Management accounting provides a means of communicating management plans upward downward and outward through the organization. Common examples of GA Costs. Audit and Assurance Council.

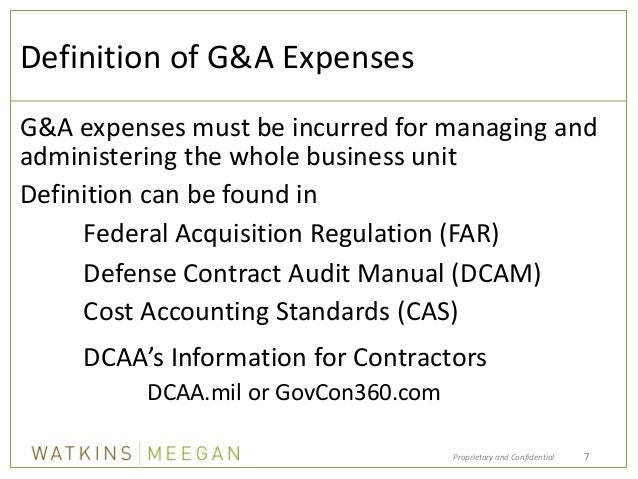

General Administrative expense GA. Generally accepted accounting principles GAAP Generally accepted accounting principles GAAP definition. The specifications of GAAP which is the standard adopted by the US.

General and Administrative or GA expenses are those that benefit the organization as a whole. Revenue Revenue is the value of all sales of goods and services recognized by a company in a period. Guns and Ammo trade magazine GA.

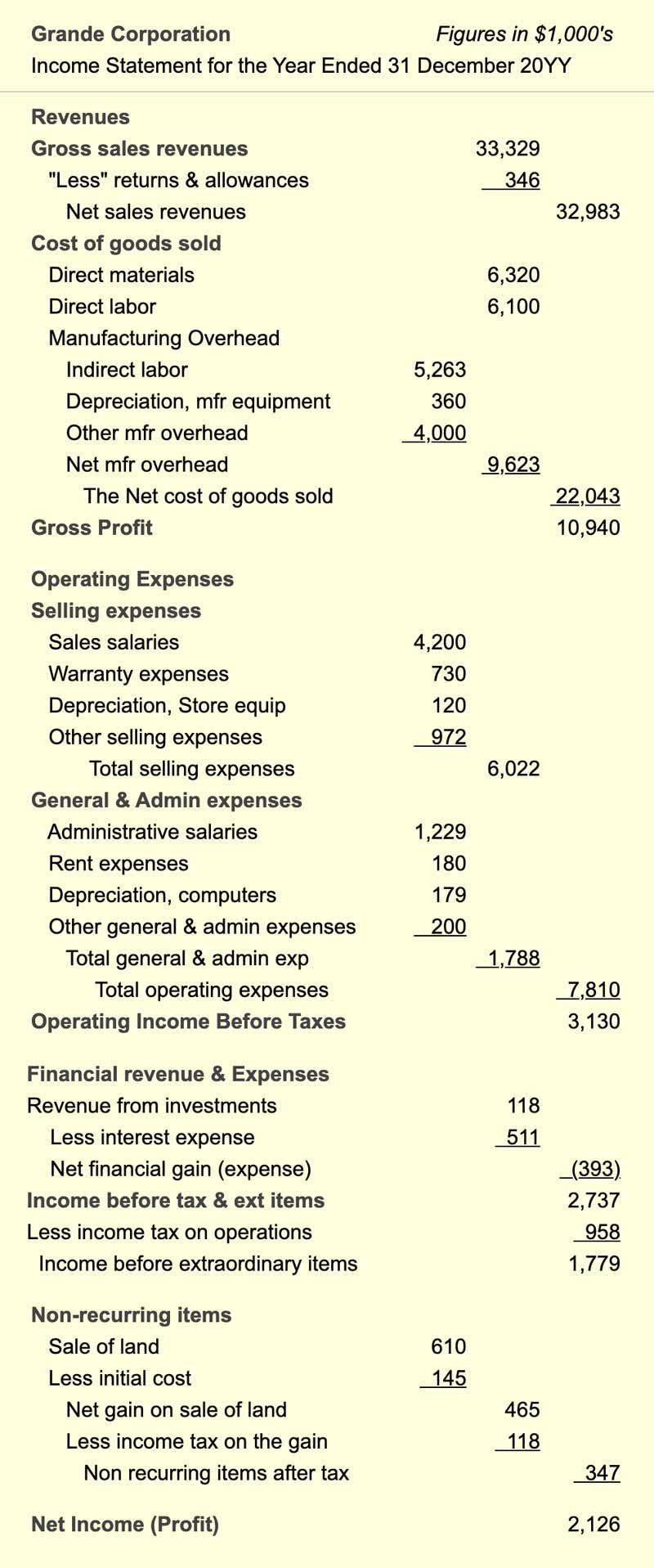

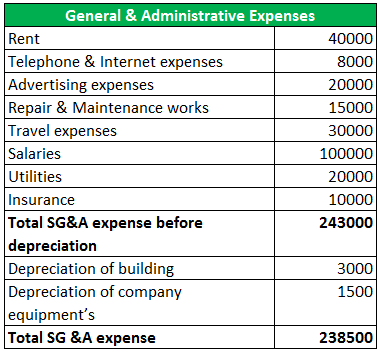

Browse 4357 acronyms and abbreviations related to the Accounting terminology and jargon. Therefore all expenses are costs but not all costs are expenses. General and administrative expenses often referred to as GA is an accounting term for a portion of a companys operating expenses.

List of 74 best GAAP meaning forms based on popularity. Labor for strategic planning business development efforts and to manage or perform administrative functions. A set of rules and guidelines developed by the accounting industry for companies to follow when reporting financial data.

General and Administrative GA expenses are the residual costs necessary to run a business regardless of whether you have government contracts. General and administrative expense is those expenditures required to administer a business and which are not related to the construction or sale of goods or services. The national association first known as the Canadian Accountants Association was founded in 1908 by a trio of Canadian Pacific Railway accountants in Montreal Quebec.

GA is accounting shorthand for general and administrative expenses. Some business expenses can be allocated to specific departments or projects for example labor and supplies for a manufacturing project or the sales forces driving to the sales department. General Administrative expense GA.

An expense is a cost that has expired or been taken up by activities that help generate revenue. Generally Accepted Accounting Principles GAAP or US GAAP are a collection of commonly-followed accounting rules and standards for financial reporting. Accounting staff wages and benefits.

Guns and Ammo trade magazine GA. Following these rules is especially critical for all publicly traded companies. GA costs can be either Support related HR Head office administration accounting etc or Technical andor Operating types like exploration development or EHS related costs etc.

Most common GAAP abbreviation full forms updated in September 2021. Examples of general and administrative expenses are. It is important to note that under the accrual method of accounting GA is recorded for the period in which it is incurred and not necessarily the period in which it is paid.

The salary of the Human Resources Director benefits all current and future company sales even if the company happens to only have one job at the time of rate calculation. Five years later in 1913 the General Accountants Association as it was then known was granted a charter from the government of Canada. Government accounting may refer to employees of the IRS who examine tax returns or to local accounting departments who manage town county or state budgets.

Because these are general expenses they typically apply to the whole company rather than one facility or department. Overhead is caused by Direct Labor. Revenue also referred to as Sales or Income.

SGA alternately SGA SAG GA or SGNA is an initialism used in accounting to refer to Selling General and Administrative Expenses which is a major non-production cost presented in an income statement statement of profit or loss. Iv Serves as a means of communicating. Securities and Exchange Commission SEC include definitions of concepts and principles as well as industry-specific rules.

/dotdash_Final_How_operating_expenses_and_cost_of_goods_sold_differ_Sep_2020-01-558a19250f604ecabba2901d5f312b31.jpg)

How Operating Expenses And Cost Of Goods Sold Differ

G A Cost Performance And The Optimism Trap Pwc

Strategic G A Approach Cooks Up Savings G A General Administrative Performance Improvement Client Result Bain Company

How Expenses Use Up Equity For Earning And Operating Business

Aligning With A New Reality Right Sizing G A To Return Free Cash Flow To Stakeholders Opportune Llp Jdsupra

What Are G And A Expenses Shakal Blog

Guide To General And Administrative Expenses G A Indeed Com

G A Cost Performance And The Optimism Trap Pwc

Overhead Versus G A General And Administrative G A Mahnke

Overhead Expense Role In Cost Accounting And Business Strategy

Sg A Expenses List Of Selling General Administrative Costs

G A Definition General Administrative Expenses Investinganswers

Selling General And Administrative Expenses All You Need To Know

:max_bytes(150000):strip_icc()/close-up-of-female-accountant-or-banker-making-calculations--savings--finances-and-economy-concept-980973568-03a13a494012414aaa835de128892345.jpg)

General And Administrative Expense G A Definition

Posting Komentar untuk "G&a Accounting Meaning"