In Accounting A Negative Amount Is Normally Presented

Assume the current balance in Allowance for Doubtful Accounts is. Negative Returns on Projects.

Badded to the face amount of the related bonds payable on the balance sheet.

In accounting a negative amount is normally presented. Asset account and Expense accounts are normally debit balances and debits are stored as positive in most accounting. Negative goodwill along with goodwill are accounting concepts created to acknowledge the challenge of quantifying the value of intangible assets such as a companys reputation patents. A summary of significant accounting policies applied including.

Using a negative sign to indicate overdraft balance would give a unified approach to problem solving. The negative goodwill NGW amount also known as the bargain purchase amount is the difference between the purchase price paid for an asset and its actual fair market value. If only one liability account has a negative sign it is likely that the liability account has a debit balance instead of the normal credit balance.

A negative balance occurs when the ending balance in an accounting record is the reverse of the expected normal balance. To illustrate assume that Rankin Companys estimates uncollectible accounts at 1 of total net sales. Such an account is said to be overdrawn and so is not actually allowed to have a negative balance - the bank simply refuses to honor any checks presented against the account that would cause it.

Bad Debt Expense Net sales total or credit x Percentage estimated as uncollectible. Failure to reflect current value information. On the other hand positive variances in terms of a companys profits are presented without parentheses.

The accounting software usually had an option to print the liability account balances on the balance sheet without the negative signs. An extensive use of estimates. An accounting entry made into a subsidiary ledger called the General journal to account for a periods changes omissions or other financial data required to be reported in the books but not usually posted to the journals used for typical period transactions the cash receipts journal cash disbursements journal the payroll journal sales journal and so on the entry is posted to the general ledger accounts directly and usually.

The accountant under these circumstances insists on having objective evidence that is evidence external to the firm itself on which to base an estimate of the amount of cash that will be received. However if we are required to avoid signs we have to change the logic for deciding whether to add or deduct the amount involved. Accounting treatment of negative goodwill.

One criticism not normally aimed at a balance sheet prepared using current accounting and reporting standards is a. In UK accounting this is often used on the income statementprofit and loss to indicate that there is a loss or a negative profit. The formula to determine the amount of the ending estimated bad debts entry is.

Invoice value of Goods sold 525000. For example if the company is 500 into the overdraft in the checking account the balance would be entered as -500 or 500 in the debit column. Calculate the amount of consignees commission.

Simpler logic in arithmetic expressions. Users expect to see financial statements presented according to the inflow flow convention with inflows represented as positive numbers and outflows represented as negative numbers. Notes are presented in a systematic manner and cross-referenced from the face of the financial statements to the relevant note.

Areported on the balance sheet as a deduction from the face amount of the related bonds payable. Prepare the year-end adjusting journal entry to record the bad debts using the aged uncollectable accounts receivable determined in a. The 500 negative balance is NOT listed in the credit column.

All of the gain should be attributed to the acquirer. Failure to include items of financial value that cannot be recorded objectively. The extensive use of separate classifications.

Screenshot_2021_0729_134636png - Question 69 In accounting a negative amount is normally presented Not answered Marked out of 100 P Flag question. This expectation is based on an accounts. A debit balance is a negative cash balance in a checking account with a bank.

The negative variances which are unfavorable in terms of a companys profits are usually presented in parentheses. Examples of Negative Variances on Accounting Reports. It will be taken as a gain in the consolidated income statement of the acquirer.

In accounting a credit with a normal balance is stored as a negative - credit accouts are. The revenue is equal to the amount of cash that will be received due to the operations of the current accounting period but this amount will not be definitely known until such cash is collected. A balance sheet accounts of Liablities and Equities and b PL Revenue accounts.

Once it is confirmed that resultant is negative goodwill than the resulting gain should be recognized in the profit and loss at the acquisition date in the books of acquirer ie. Illustrative financial statements are presented in appendix A paragraph 34 to this statement of position. Academics Department The Institute of Cost Accountants of India Statutory Body under an Act of Parliament Page 4 commission of 20 percent of any surplus realized.

Normally consider estimated current value information to be more relevant for. Creported in the Paid-In Capital section of the balance sheet. Should an account have a negative balance it is represented as a negative number in the appropriate column.

Negative goodwill is an accounting principle that occurs when the price paid for an asset is lower than its value in the market and can be thought of as a discount to the buyer. If we are interpreting the balances in terms of overdraft balances then a normal balance would be a negative balance. A negative amount A number in parenthesesbrackets can often indicate that a number is negative.

The amount by which the actual net income was less than the budgeted net income. Negative returns can also be used in relation to projects that companies invest in usually requiring debt financingFor example a company decides to purchase new. Dreported separately in the.

Calculate the total estimated bad debts based on the above information. IAS 1113 IAS 1114 suggests that the notes should normally be presented in the following order a statement of compliance with IFRSs. Amount as an investment if the entity is marketable as a going concern.

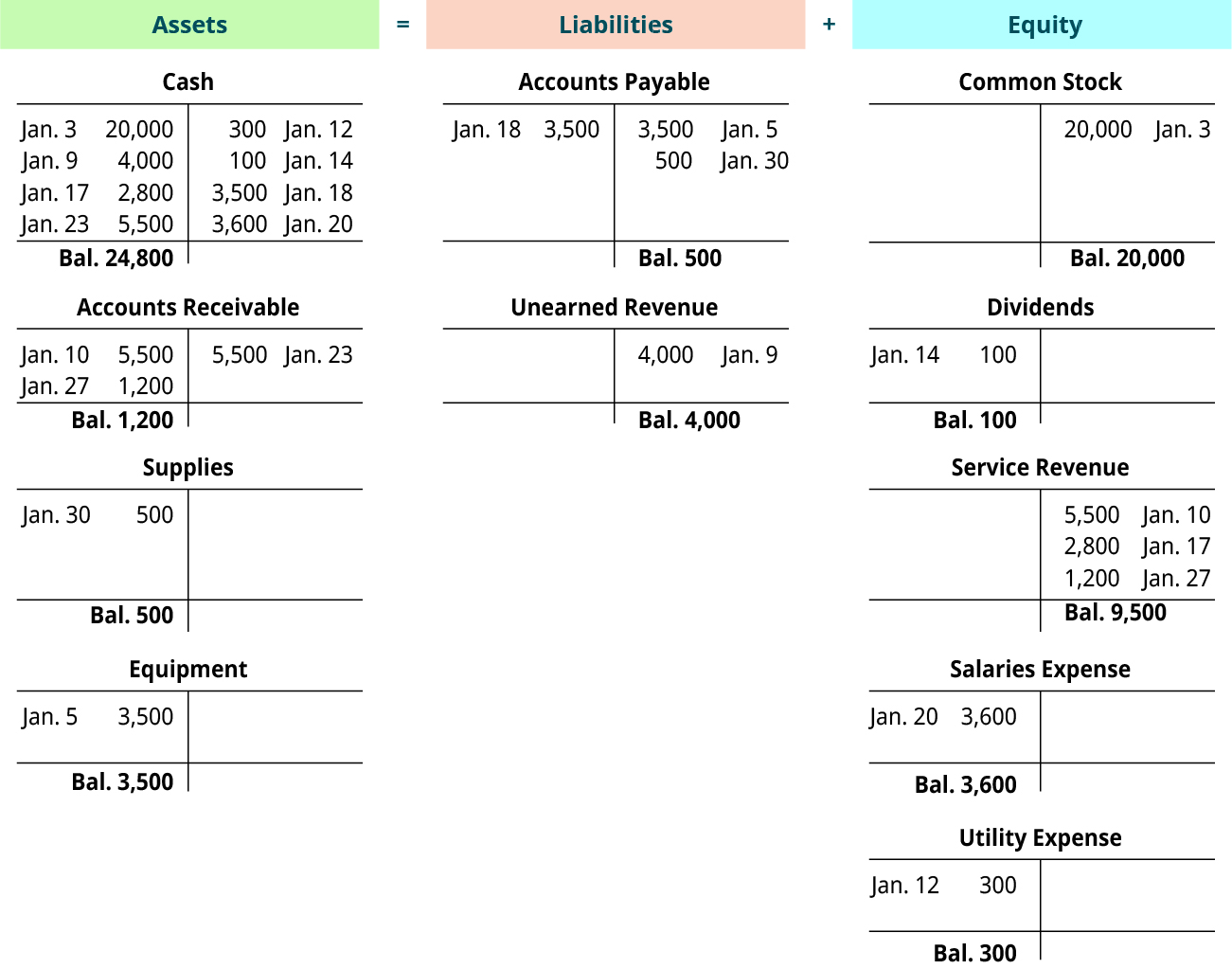

Use Journal Entries To Record Transactions And Post To T Accounts Principles Of Accounting Volume 1 Financial Accounting

Common Digital Multimeter Symbols Electrical Engineering Blog Multimeter Electrical Engineering Medical Malpractice Lawyers

The Reiki Master Degree Initiation The Secret Process Negative Energy Energy Healing Reiki Reiki Master Reiki Healing Learning

Real Estate Agent Expenses Spreadsheet Spreadsheet Financial Plan Template Real Estate Information

Accounts Debits And Credits Principlesofaccounting Com

Agriculture Infographic For The Classroom Agriculture Education Character Education Agriculture

Humilitya Symbol Of Spiritual Maturity Spirituality Healthy Happy Life Maturity

Which Accounts Would Normally Not Require An Adjusting Entry P S Of Marketing Accounting Books Accounting Cycle

Accounting Quizzes By Sir Daneyal Online Tutor For Inter Commerce Pakistan Online Tutoring Accounting Online Coaching

How To Change Negative Amount To Positive In Excel Video 001 Positivity Negativity Excel

21 Balance Sheet Templates Download Free Formats In Word Excel Pdf Balance Sheet Template Balance Sheet Budget Planner Printable

Outstanding Salary Is A Nominal Account Or A Real Account Or A Personal Account In 2021 P S Of Marketing Accounting Books Accounting

Acc 305 Final Exam Part 1 Final Exams Exam Inventory Accounting

Posting Komentar untuk "In Accounting A Negative Amount Is Normally Presented"