0 Interest Loan Accounting

Case- 2 Director provides loan to the Entity that bears no interest but the Loan agreement specifies Loan is repayable on-demand. The debit to the loan account records the reduction in principal of the loan balance which is the cash repayment less the interest expense.

Pdf Redirect 2 5 Free Pdf Creator Brazdeskpa Business Budget Template Spreadsheet Template Small Business Bookkeeping

Lets say Company A lends 100000 to Company B repayable in full upon maturity in 3 years time at 0 when the market interest rate is 8.

0 interest loan accounting. No principal payment is required until the loan comes due in two years. I know form CT61 needs to be completed. It is worth noting that in some parts of the world eg South Africa loans without stated repayment terms are deemed to be legally payable on demand under the local law.

The company is paying 6000 gross interest of which 1200 income tax will be deducted. It is recognised at the actual amount. What is the accounting treatment for -0- interest loans for balance sheet and PL.

125000 0 125000. Aug 20 2009 0957 PM 0 interest that means no interest expense for PL. A business may own one or more loans that are payable by third parties.

Permit returning the loan to accrual status. Accounting for -0- interest loans. If so the loan should be accounted for as an on-demand asset or liability see guidance.

The companys accountant records the following journal entry to record the transaction. The compound Journal entry for loan repayment including both principal and interest are as follows. If your Propco wants to adopt FRS102 accounts to be able to revalue its property assets and over say 20 years it might especially if expansionfurther purchases are envisaged if you have a fixed terminterest re the loan you will likely need to revalue the loan by discounting within the Propco accounts- read the sections on Financial Instruments in attached.

Accounting entry for interest on loan Credit. Assume that on July 1 a company borrows 100000 with an annual interest rate of 12. Case- 3 Loan by the Director agreed to be paid at the discretion of the Entity.

Assume this is done ex-gratia by Company A that is Company A attaches no conditions with. You should discount the loan given at the market interest rate to find the fair value of loan and record the loan at fair value. How to account for the tax and interest payment.

Liability for loan is recognized once the amount is received from the lender. On July 1 the company records the loan as follows. The PwC 2014 study shows diversity in accounting for loans and borrowings.

The difference between the fair value and the amount paid could be recognized as a finance expense and charged to income statement or you may also defer this charge and amortize over the period of two years. Accounting for Interest-Free Loans. Whether loan is given or loan is taken it is must to record it in books because given loan is our asset and taken loan is our liability.

3 Steps for Accounting for Interest-Free Loans and Imputed Interest Expense. Accounting treatment on interest on directors loan. This simple interest calculator calculates interest between any two dates.

The debit to the interest expense records the accounting entry for interest on the loan for the year calculated at 6 on the beginning balance. A loan to an entity that is due on-demand is a financial instrument. You can calculate the accrued interest from any point in.

Assets Capital Liabilities. Management should also ensure that all payments received while the loan is on nonaccrual are applied in accordance with Generally Accepted Accounting Principles. If the short-term federal interest rate is 2 percent the amount of interest you would owe is 100000 multiplied by 02 which equals 2000.

I have a director who wants to charge interest on the amount he has loaned the company. Accounting for Nonaccrual Loans. Upon receipt of the interest-free loan the nonprofit should record the loan at face value and the restricted contribution revenue at the fair value of the interest-free.

So for knowing actual balance of loan outstanding we need to pass journal entries. As per the Accounting Equation the Total Assets of the company are the total sum of total Capital and total liabilities. Where there is no difference between the initial carrying amount of the loan and the amount repayable the effective interest rate is equal to the contractual interest rate which is zero.

Only the loand have to b charged to Balance Sheet as a Liability. 19 Accounting treatment of loans and borrowings 7-8 May 2018 14 15 13 11 0 10 20 30 Loans Borrowings Number of EU countries Amortised cost Other method. Interest expense is calculated on the outstanding amount of the loan.

According to IFRS 9 a long-term loan or receivable that carries no interest should be recognised at fair value measured as the present value of all future cash receipts discounted using the prevailing market rates of interest for a similar instrument currency term etc with a. If the financial circumstances of these borrowers declines the following issues may arise that require accounting treatment. Debit Cash for 100000 the.

The interest for each month is to be paid on the last day of the month. So your parents decide to lend you 100000 interest-free to buy a house with a promissory note to pay back the loan in 10 years. Management is strongly encouraged to consult with the financial institutions accountants.

Journal Entry when the repayment is made. Absolution Corporation which produces paraphernalia for churches makes a monthly loan payment to its lender of 4000 of which 1000 is an interest payment and 3000 is a principal payment. Because this calculator is date sensitive it is a suitable tool for calculating simple interest owed on any debt.

Example of an Interest Only Loan. Even in the absence of legislation loans without stated. Moreover on the basis of outstanding balance interest is calculated and it is paid by borrower to lender.

Accounting for loan payables such as bank loans involves taking account of receipt of loan re-payment of loan principal and interest expense. March 8th 2021 No Comments. Consequently there are no entries to be made in years 1 to.

A loan is considered to be impaired when it is probable that not all of the related principal and interest payments will be collected.

Get Skilled In Finance Accounting Accounting Small Business Accounting Software Small Business Accounting

Unique Monthly Cash Flow Statement Template Xls Xlsformat Xlstemplates Xlstemplate Laporan Arus Kas Inisial

Frackin Reserve A Fractional Reserve Banking Simulator Simple Calculator Banking Simulation

Cara Mudah Membuat Tabel Analisa Umur Piutang Excel Akuntansi Keuangan Laporan Keuangan Keuangan

New Collection Etc Catalog Cash Flow Statement Budget Template Cash Flow

Simple Income And Expense Tracker Bookkeeping Template For Etsy Bookkeeping Templates Small Business Bookkeeping Expense Tracker

Loan Amortization Schedule Amortization Schedule Schedule Template Loan Repayment Schedule

Financial Literacy Understanding Calculating Compound Interest Personal Finance Compound Interest Math Finance Financial Literacy

Cara Mudah Membuat Laporan Arus Kas Dengan Kertas Kerja In 2021 Laporan Arus Kas Kerja Keuangan

Pin By Nagalaxmi B On Loans In 2021 Personal Loans Freedom Bank Account

Http Www Adclickxpress Is R 2etgpv3epe9 P Aa Here Is Payment Proof Details Date 31 03 2016 06 14 To Pay Processor Account U9 Payment Get A Loan Accounting

Adclickxpress Proof Withdrawal This Is An Evidence Of My First Withdraw From Acx As A Housewife You Will Do Yourself A Gr Money Lending Online Work Get A Loan

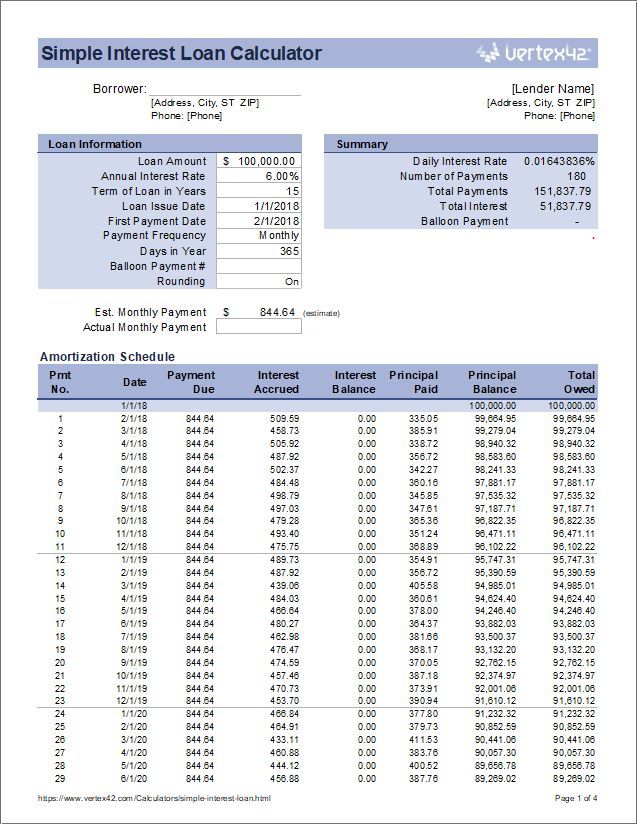

Download The Simple Interest Loan Calculator From Vertex42 Com Mo0rtgage Cal Amortization Schedule Mortgage Amortization Calculator Mortgage Calculator Tools

Posting Komentar untuk "0 Interest Loan Accounting"